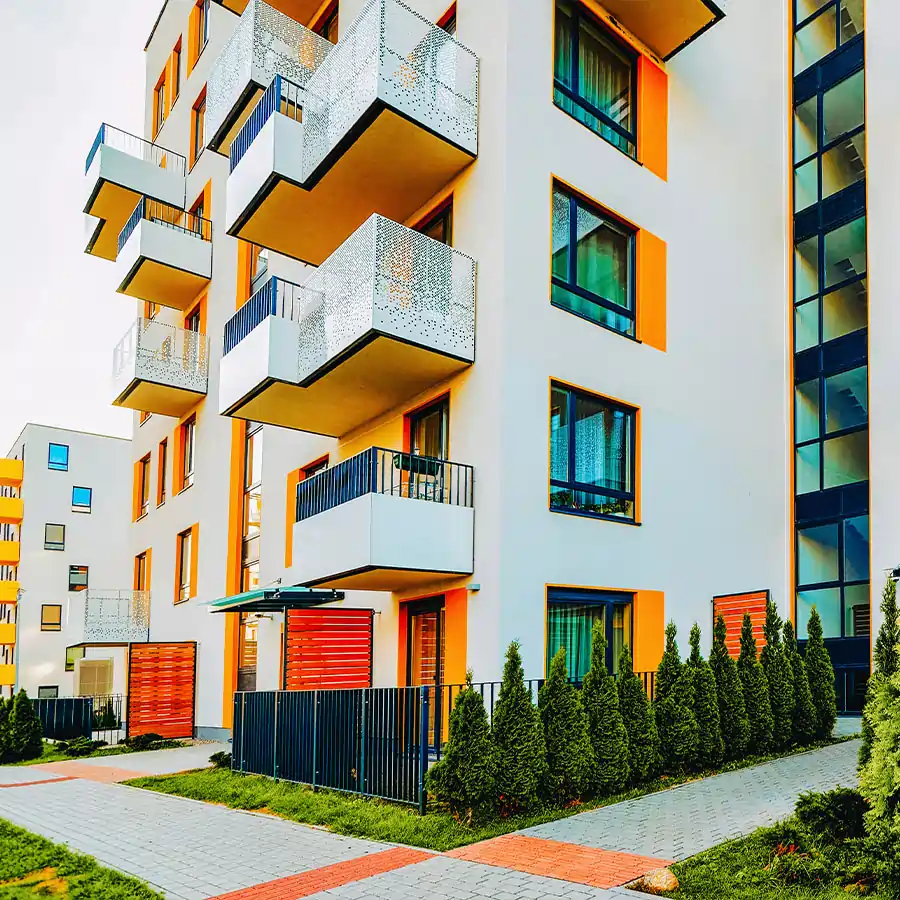

Coverage when you rely on monthly rental income from tenants

We have great landlord insurance options for your rental property with coverage for liability, rental income and building damage. If you own rental properties or have renters in your home, you’ll require specific coverage that a general home insurance policy cannot provide. Landlord insurance not only covers damage to your property, but it can also cover lost income if your tenants have to find alternate accommodations after a claim.

How much is landlord insurance?

The amount of coverage you’ll need depends on the number of tenants you have, and kind of rental properties you own. For example, renting a home to a family will have different coverage requirements than a student renting a room. As a brokerage for over 70 of Canada’s top insurers, we have lots of coverage options, no matter what kind of rental property you own.

What does landlord insurance cover?

Most landlord insurance policies are customized to meet your individual needs based on the type of property, but there are some standard coverages that help to protect landlords from common risks.

Your belongings

If you rent out a furnished property, contents coverage protects the possessions you own that are at the rented property. Vandalism and theft are excluded.

More about contents coverage

Liability

If a tenant or visitor is accidentally injured on your property or decides to sue you, liability protection can help you cover medical and legal fees.

More about personal liability coverage

Structure coverage

Protects the actual structure, meaning the house or condo unit, from fire, water damage and other perils. This doesn’t cover vandalism.

Fair rental income

If your property becomes unlivable for any reason and your tenants are required to leave, you can be reimbursed for lost rental income up to a limit.

What types of properties do I need landlord insurance for?

The number of tenants you rent to and the type of rental properties you own will determine what coverage you require. Here’s a few types of rental properties that require landlord insurance:

Home rentals

Protects single or multiple-family homes with long-term renters in them. Discounts may be available for landlords with renters who have tenants insurance.

Rented condos

Own a condo unit you rent out? Condo landlord insurance protects parts of the unit not covered by the condo association and other risks related to tenants.

Student room rentals

If you rent rooms in your house to students, your ordinary home insurance policy doesn’t fully protect you. You’ll need landlord coverage to be safe.

Airbnb rentals

Short-term rentals through Airbnb or Vrbo need a special kind of landlord insurance to protect your property and cover you from any liability.

Apartment buildings

This is not personal insurance. If you own a residential building that houses seven or more families, you need commercial landlord insurance.

All home insurance categories

We offer many types of home, condo, landlord and tenants insurance packages. Check out all of our home insurance products.

Help your tenants protect the things they love

Your landlord insurance does not cover the personal belongings of your tenants or provide them with liability coverage. We highly recommend asking your renters to consider purchasing a tenant’s insurance package. This will cover items like their furniture, TV, iPads, cash, and jewelry, if they’re damaged by fire or water in an incident that they have caused.

Frequently asked questions about landlord insurance

Why should I get landlord insurance?

Your regular homeowner’s insurance doesn’t provide enough coverage if you rent to tenants. Whether you’re renting out your basement or multiple investment properties, getting landlord insurance is a smart move.

What does landlord insurance cover?

Landlord insurance typically covers the entire building, or the parts you’re renting. It’ll also replace lost rental income if you can’t rent the property because it’s been damaged. Airbnb rentals aren’t covered by typical landlord policies and need a special kind of insurance. If all of this sounds confusing don’t worry, we’ll help you sort it out. Give us a call 1.800.731.2228

How much does landlord insurance cost in Ontario?

In Ontario, average residential landlord premiums cost around $900 a year for a house and $400 a year for a condo or apartment. If you’re renting out a commercial property, the premiums are based on the size of the space and how it’s being used. Learn more about the cost of landlord insurance.

Does landlord insurance cover loss of rent?

Many landlord insurance policies will defend the landlord in the event of loss of rent because of a covered loss. This is called fair rental value coverage. It won’t cover you if your tenant is unable to pay rent due to financial issues or unemployment. Learn more about fair rental value coverage.

Does landlord insurance cover tenant damage?

No, landlord insurance does not cover damage caused by tenants or damage to tenants’ belongings. Some policies will cover certain unintentional damages caused by tenants, like fire accidents, but it’s generally recommended landlords require their tenants to carry their own insurance policies.

How much is landlord insurance for a condo?

In the GTA, average condo landlord insurance premiums range from $500 to $800 a year. Because the overall building is insured by the condo corporation, rates tend to be lower than most landlord policies.

Is landlord insurance mandatory in Ontario?

No, landlord insurance is not mandatory in Ontario. However, some lenders will require insurance, like how mortgage lenders or financial institutions require home insurance when securing a loan.

Can I claim landlord insurance on my taxes?

Yes, you can deduct your landlord insurance premiums from your rental income when you file your taxes.

When should I get landlord insurance?

If you have tenants, we suggest getting a landlord policy right away. If something happens and you need to make a claim, it may not be covered if your insurance company was unaware that you were renting out the property.

What’s the difference between home insurance and landlord insurance?

Landlord insurance generally costs around 20% more because of the added risk of someone else living in your property. Landlord policies usually don’t cover theft or vandalism.

Can I ask my tenants to have renters insurance?

Yes, this should be added as a requirement in your standard lease agreement. Learn about why you should require your tenants to carry insurance.

Do I need landlord insurance if renting to family?

Yes, even if your tenants are related to you – even if they’re your elderly parents, siblings, cousins, etc. – you’ll need landlord insurance. Regardless of trust, adequate insurance and a tenancy agreement is a must so long as you’re offering a place to stay in exchange for rent payment.

Does landlord insurance cover tenant vandalism?

Generally, yes, landlord insurance covers damages caused by tenant vandalism up until a certain limit (often $100,000). It may be limited when it comes to damages from everyday use, interior vandalism, or if a tenant steals your property.

Should landlord name tenant as additional insured?

An additional insured is someone entitled to coverage under your policy. Landlords should usually require that tenants have their own tenant policy versus being covered under your policy, to avoid having them use the landlord’s policy and potentially impacting your rates.

Being a brokerage for over 70 of Canada’s top insurers means we have access to a wide range of insurance solutions at some of the best rates in Ontario. Want to learn more about the coverage options available to you? Here’s a few of them.